Cautious optimism in the post-POGO Metro Manila office market

THREE MONTHS since the pronouncement of the ban of Philippine Offshore Gaming Operators (POGOs), Metro Manila’s office market recorded its first negative net take-up in a quarter since the fourth quarter (Q4) of 2021. In Q3 2024, net take-up declined by -33,000 square meters (sq.m.), mainly attributed to lease terminations by POGO and non-renewal of […]

THREE MONTHS since the pronouncement of the ban of Philippine Offshore Gaming Operators (POGOs), Metro Manila’s office market recorded its first negative net take-up in a quarter since the fourth quarter (Q4) of 2021. In Q3 2024, net take-up declined by -33,000 square meters (sq.m.), mainly attributed to lease terminations by POGO and non-renewal of leases that were closed before the pandemic. While this raises some concerns, especially for developers with significant vacancies, other indicators — such as demand — show signs of resilience, offering cautious optimism in a challenging office market.

POGOs HEADING FOR THE EXIT

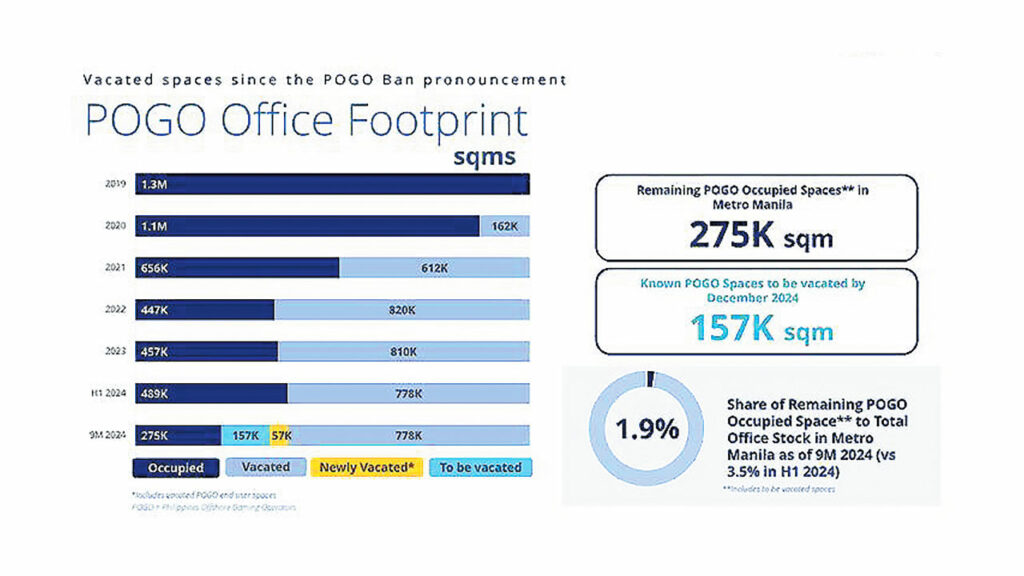

As of the first nine months of 2024, Colliers has noted new and upcoming surrenders from POGO occupiers in 2024. For Q3 2024 alone, we recorded 57,000 sq.m. of newly vacated spaces and expect another 157,000 sq.m. of vacancies by end of year as some operators have already notified their landlords of their lease terminations and non-renewals. The current POGO occupied stock of 275,000 sq.m. only represents 1.9% of the total stock in Metro Manila. During its peak years, around 1.3 million sq.m. of office space was leased out by POGOs.

Without the POGO ban, the year-to-date net take-up would have reached 195,000 sq.m., surpassing half of 2023’s full-year total of 280,000 sq.m. However, given the expected surrenders, Colliers projects a flat or zero net take-up by year-end, indicating no change in overall occupied space from 2023 to 2024.

ROBUST DEMAND FROM IT-BPM AND TRADITIONAL OCCUPIERS

Even without POGOs, office demand in Q3 2024 performed better than the quarterly average of 174,000 sq.m., indicating a robust demand as traditional and outsourcing companies continue to take up space. This also signals that the POGO ban has not dampened demand from these two tenant classes and may even offer them greater flexibility and choice in meeting their office space requirements.

As of Q3 2024, a total of 651,000 sq.m. office transactions were recorded, with new transactions in Q3 2024 amounting to 192,000 sq.m. Deals in Q3 were 12% lower quarter on quarter (QoQ) and 2% lower year on year (YoY). Traditional firms, including government agencies, cornered 53% of the total transactions recorded, followed by third party outsourcing/3POs (29%), POGO (11%), and Shared Services (7%). It is also worth noting that 3POs and Shared Services saw significant increases in transactions volume for both YoY and QoQ.

Expansion remains the primary motivation for office space take-up, accounting for 57%, followed by relocations at 36% and new setups at 7%. Notably, expansions are concentrated in Makati CBD, Fort Bonifacio, Bay Area, Quezon City, and Alabang, where prominent IT-BPM companies have a significant presence. Among IT-BPM firms specifically, expansion drives a substantial 70% of space demand.

Across all submarkets, the Bay Area leads in leasing activity, capturing 26% of Metro Manila’s total transactions, followed by Fort Bonifacio at 18% and Quezon City at 16%. With the recent passage of a tax ordinance incentivizing office expansions and relocations, Quezon City is expected to see further demand growth from traditional occupiers.

The countryside continues its upside momentum as shown by the increase in deals recorded, which is mainly attributed to the expansion of outsourcing companies. Provincial transactions are now at 189,000 sq.m., up from 155,000 sq.m. posted in the same period of 2023. Cebu captured 32% or about 69,000 sq.m. of total provincial transactions and emerges as the only provincial market performing almost at par with primary Metro Manila CBDs such as Makati (88,000 sq.m.) and Ortigas (56,000 sq.m.). Interestingly, provincial transactions now comprise 29% of nationwide deals recorded as of Q3 2024, which was previously hovering between 20-25% in the past four years. Given this, we encourage landlords to ramp up developments in provincial areas to accommodate the demand from outsourcing companies.

HIGHER VACANCY RATES IN POGO-EXPOSED LOCATIONS

As of Q3 2024, overall Metro Manila vacancy marginally rose to 18.5% from 18.3% in Q2 2024. The increase in vacancy is mainly driven by POGO surrenders and non-renewal of leases. Primary CBDs such as Makati, Fort Bonifacio and Ortigas continue to experience below market vacancies and are likely to recover faster versus secondary markets. By end-2024, we project overall market vacancy to reach 20.5% given the expected surrenders from POGOs and non-renewals.

Meanwhile, locations with high POGO exposures such as the Bay Area and Makati Fringe are seen to experience higher vacancy rates by year end. Landlords with POGO exposures are encouraged to give additional concessions for previously vacated POGO spaces. It is important to note that occupiers will take advantage of vacated spaces by POGOs especially if these are workable for them. Landlords may consider providing tenant improvement allowances, reinstating spaces to suit traditional and outsourcing operations and offering flexible commercial terms.

‘SILVER LININGS’ IN A CHALLENGING MARKET

Despite concerns over the current state of Metro Manila’s office market, there are still positive indicators and opportunities for growth — especially when examining the market at a more granular level. Low vacancy markets may be indicative of an opportunity for landlords to enhance their office space offerings and ramp up projects already in the pipeline. Importantly, demand has remained resilient despite current headwinds. The worst-case scenario of zero demand has been avoided, with ongoing office deals from traditional businesses and outsourcing firms underscoring the market’s resiliency.

Given these, landlords are encouraged to provide high-quality office spaces that align with the latest demands for flexibility, wellness, and sustainability. By addressing these specific tenant expectations and remaining attentive to shifts in demand, landlords can capitalize on the existing market opportunities and create spaces that are better positioned to thrive even in a challenging landscape.

Looking ahead, the outcomes of the recent US elections and the resulting policy shifts may have significant implications for business activities, as well as opportunities that may arise for Metro Manila’s office market.

Kevin Jara is a director for Office Services-Tenant Representation while Kath Taburada is senior market analyst, Office Services-Tenant Representation at Colliers Philippines.