Growth forecast and Trump’s trade policies

Last week the Philippine Statistics Authority (PSA) released the gross domestic product (GDP) data for the third quarter (Q3) of 2024. It showed that the GDP grew 5.2% from the level a year ago. This is low compared to the estimates made by economists in a BusinessWorld poll, with a median estimate of 5.7% for […]

Last week the Philippine Statistics Authority (PSA) released the gross domestic product (GDP) data for the third quarter (Q3) of 2024. It showed that the GDP grew 5.2% from the level a year ago. This is low compared to the estimates made by economists in a BusinessWorld poll, with a median estimate of 5.7% for the July-to-September period. But this is still high compared to other Asian and European economies (except Vietnam) that reported their Q3 GDP too.

GROWTH IN 2024 AND PMI

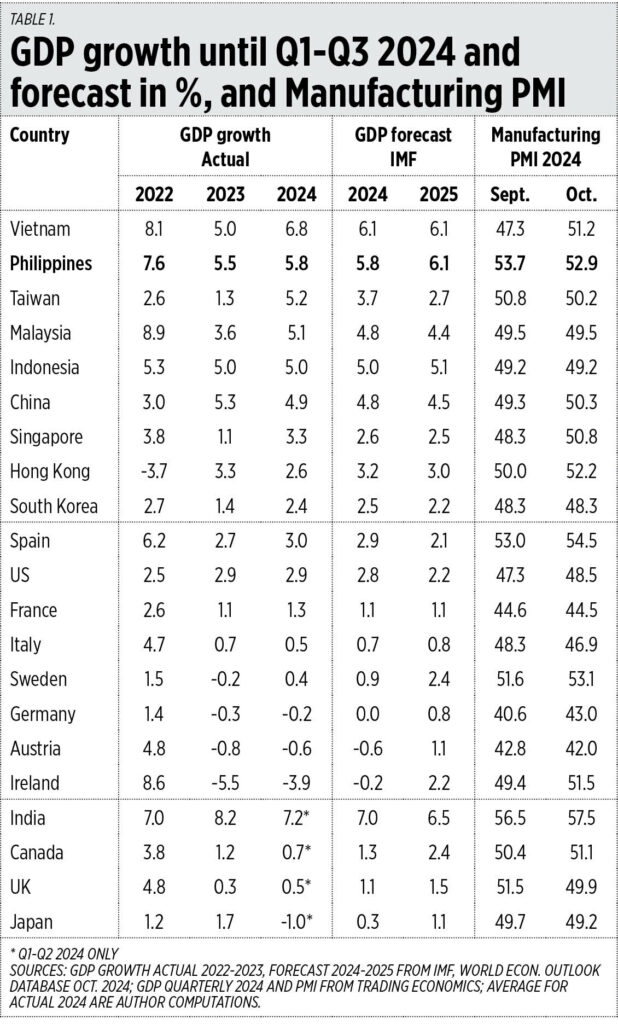

The Philippines’ average growth in the first three quarters (Q1-Q3) of 2024 is now 5.8%, second fastest to Vietnam’s 6.8%. Other East Asian countries have had modest growth of 2.4% to 5.2% while European nations have either been crawling, or contracting like Ireland’s -3.9%. Spain and Turkey are the exceptions to this European trend.

I also checked the Manufacturing Purchasing Managers’ Index (PMI), an indicator of companies’ optimism or pessimism towards the short-term business outlook. The Philippines’ PMI was the second highest in Asia at 52.9 last October, next to India’s 57.5. Most European countries’ PMIs were below 50 (see Table 1).

At Stratbase’s “Pilipinas Conference 2024” on Nov. 7, held at the Manila Polo Club in Makati, Finance Secretary Ralph G. Recto gave the keynote message and highlighted the expansion of the country’s GDP size. He said that “The Philippine economy has already doubled its size since 2013 in terms of nominal GDP. And by 2030, our projections show that we can grow by another two-fold.”

He also mentioned the country’s demographic dividend (a young, big population of producers and consumers, entrepreneurs and workers) as a “golden moment to strengthen our already dynamic labor force.”

Budget Secretary Amenah F. Pangandaman was also scheduled to speak at the event, but as she was in the Singapore Fintech Festival that day, she delivered a virtual but live speech. She highlighted the rapid push in digitally transforming the government’s bureaucracy, with P72.1 billion support for ICT-related programs and projects of government agencies. She also mentioned a new law — the New Government Procurement Act (NGPA), meant to make official procurement more transparent — that will help reduce waste and corruption.

FORECAST 2025

This is the theme of the BusinessWorld Economic Forum (BWEF) 2024, which will be held on Nov. 26 at the Grand Hyatt Manila. The annual BWEF has become an institution, a big national economic and business conference that features the ideas and outlooks of key leaders in government and corporations.

As shown in the accompanying table, the IMF forecast for the Philippines’ full year growth in 2024 is 5.8%, and 6.1% in 2025. The IMF sees the Philippines and Vietnam tied as the second fastest growing major economy in the world next year after India’s 6.5%.

TRUMP’S TAX AND TRADE POLICIES

US President-elect Donald Trump’s plans for one-two punches of low taxes and high tariffs in 2025 are creating mixed feelings in many countries around the world.

Trump’s main concern is the US’ perennially high trade deficit, so he plans two major policies. The first is to further reduce the US corporate income tax rate — which was 35% until 2016, then was brought down to 21% in 2017 during his first term — to around 15%. The second is to raise tariffs on products made by companies abroad that sell to the US, with a target tariff of 60% on goods from China, and 20% on those from other economies. This is meant to reward companies that locate and stay in the US and directly create jobs there and penalize companies that locate their facilities in other countries and sell their products to the US and thus do not directly create jobs there.

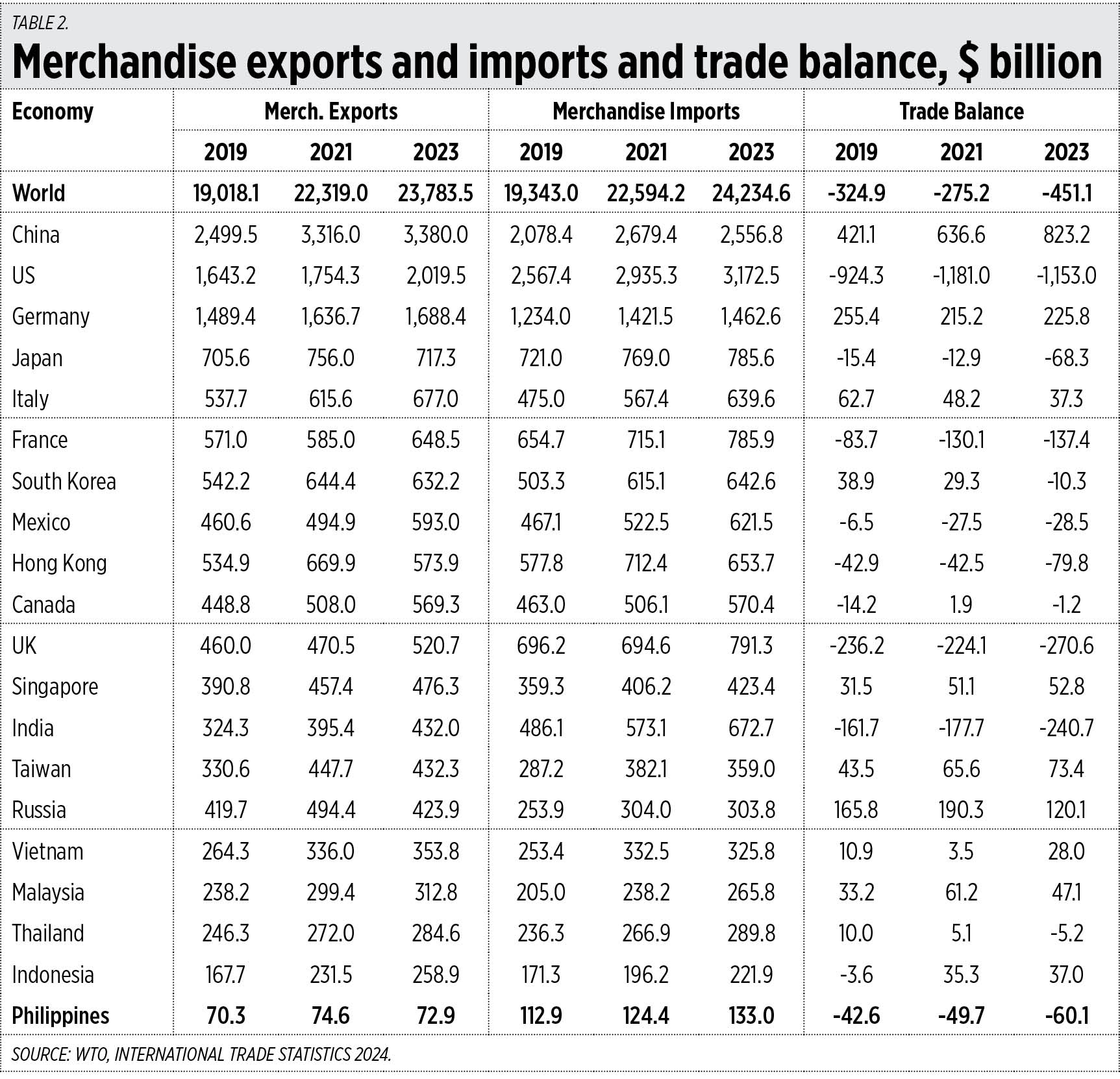

I checked just how big the US trade deficit that angers Trump is. For the purpose of brevity, I chose to highlight only three years. The US trade deficit in 2019 was $924 billion or $2.53 billion/day, in 2021 it was $1.181 trillion or $3.24 billion/day, and in 2023 it was $1.153 trillion or $3.16 billion/day. This is huge.

While the US has the highest trade deficit in the world, China has the highest trade surplus: $421 billion in 2019 and $823 billion in 2023. The country with the next highest trade surplus is Germany followed by Russia (see Table 2).

Instead of fearing Trump’s tax and trade policies, we should welcome them. Let us also cut the taxes on individual and corporate income, letting the people and companies keep more of the product of their hard work and savings, thus encouraging more businesses and job creation. When people have jobs — good paying jobs — they become more self-reliant and less dependent on state subsidies for their household’s education, healthcare, housing, food and other needs. Thus, the government’s high spending on subsidies, and the high borrowings needed to cover the budget deficit, can be controlled.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.