Some economic background of the US elections, lessons for the Philippines

As the US Presidential elections are in two weeks, this column will try to compare the economic performances of the administrations of former President Donald Trump and Vice-President Mike Pence (2017-2020), and President Joe Biden and Vice-President Kamala Harris (2021 to present). The baseline data is 2016, the last year of the Obama administration. For […]

As the US Presidential elections are in two weeks, this column will try to compare the economic performances of the administrations of former President Donald Trump and Vice-President Mike Pence (2017-2020), and President Joe Biden and Vice-President Kamala Harris (2021 to present).

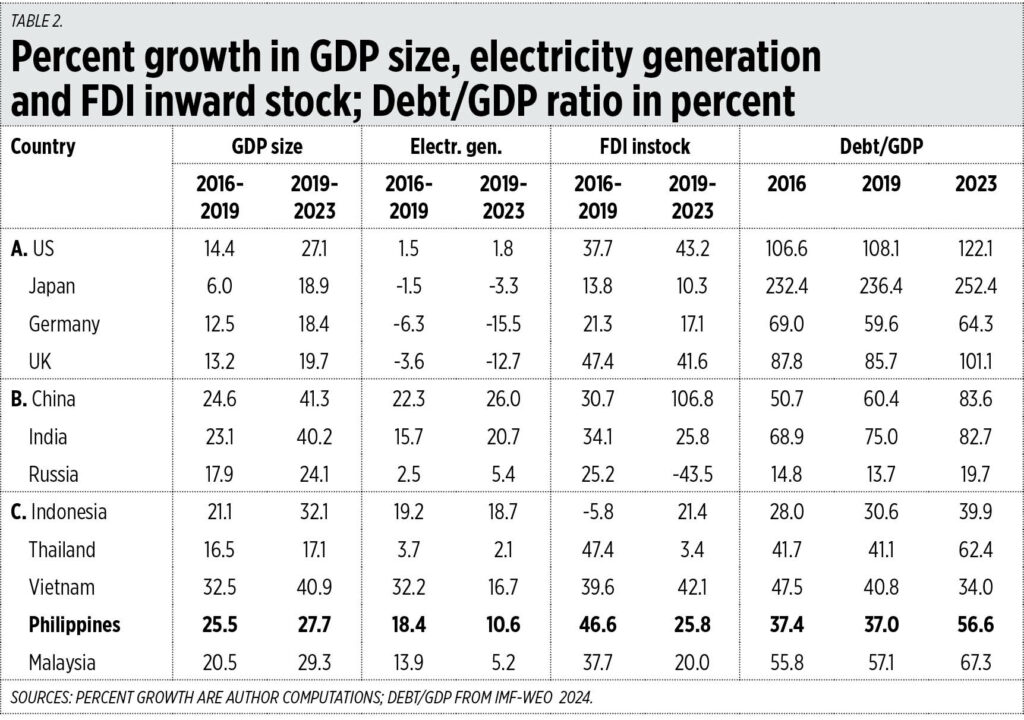

The baseline data is 2016, the last year of the Obama administration. For the Trump/Pence period, 2019 is used because 2020 is “outlier” with all the COVID-19 lockdowns worldwide, and for Biden/Harris, 2023 is used because 2024 is not over yet.

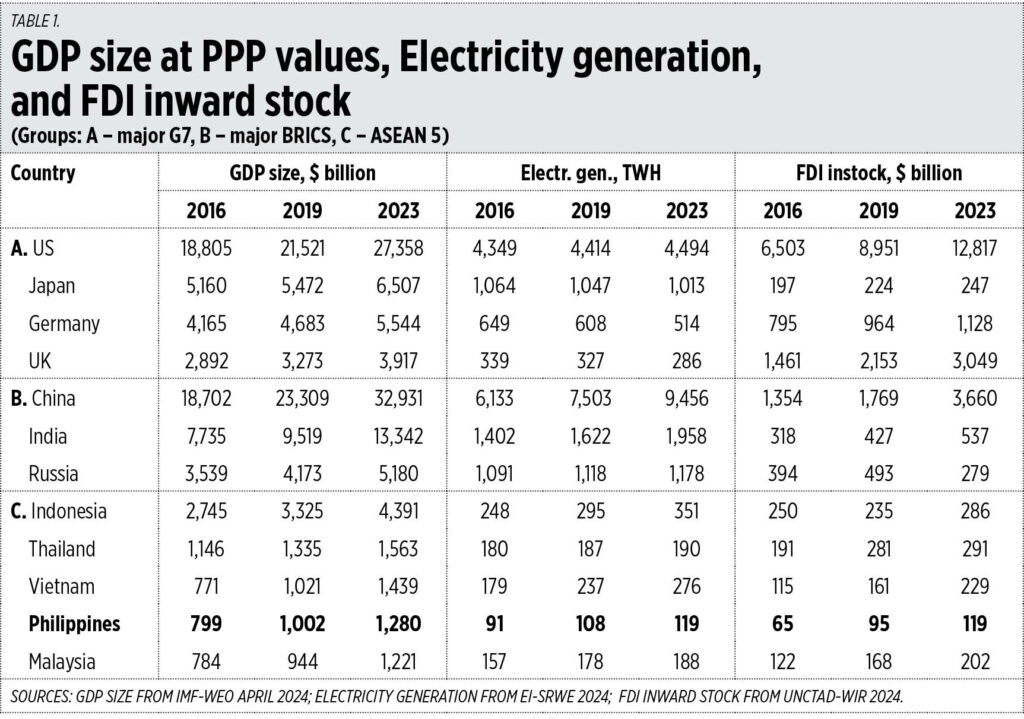

The comparison data are GDP size at purchasing power parity (PPP) values, electricity generation in terawatt-hours (TWh), and foreign direct investment (FDI) inward stock which is accumulated FDI inflows minus outflows.

The data sources are the databases of the International Monetary Fund (IMF) World Economic Outlook (WEO) April 2024, the Energy Institute’s Statistical Review of World Energy (EI-SRWE) 2024, and the UN Conference on Trade and Development (UNCTAD) World Investment Report (WIR) 2024.

The data so far show the following.

1. There was significant expansion in the US’ GDP size under Biden/Harris but GDP growth was also experienced by China, India, Russia, and the ASEAN-5 except Thailand as shown in percent growth.

2. There was lackluster expansion in electricity generation under both Trump/Pence and Biden/Harris administrations. But at least there was no contraction in the US, unlike in other G7 countries like Japan, Germany, and the UK.

3. There was a significant expansion in FDI inward stock under both the Trump/Pence and Biden/Harris administrations, both in values and percent growth (see Tables 1 and 2).

4. Looking at the Debt/GDP ratio, Trump added only 1.5 percentage points, from 106.6% in 2016 to 108.1% in 2019. But Trump made the big mistake of listening to the World Health Organization, the Centers for Disease Control, Dr. Anthony Fauci, and others about imposing a hard lockdown in the US during the COVID-19 pandemic, and US debt expanded big time during that period with the government giving away lots of subsidies and freebies in 2020 while its revenues declined.

Despite the big income tax cut under Trump — from 35% to 21% by 2018 — public debt did not increase as “predicted” by high tax-loving Democrats. Because Trump made some spending cuts, like not entering into a new US war abroad, to match the tax cut.

That major income tax cut by Trump starting 2018 should be considered one of the big factors why FDIs and overall GDP size significantly expanded in the US.

During the current election campaign period, Trump said that if he wins he will make another US income tax cut, from 21% to 15%, and raise US tariffs for imports abroad. So a one-two-punch of rewarding companies that invest in the US via a low income tax, and penalizing companies abroad that sell to the US. In the process, more investments and job creation will happen in the US.

But for me the most important planned Trump policy — if he wins in two weeks — is “no new US war abroad,” a policy he followed from 2017-2020 during his term.

LESSONS FOR THE PHILIPPINES

There are some lessons to be learned from the numbers above that our government economic team should consider.

1. We should not entertain an income tax hike, but rather move for an income tax cut someday, to be compensated by a higher number of new businesses and some spending cuts and borrowings cuts.

I refer to one report in BusinessWorld yesterday: “‘Wealth tax’ can fund efforts to combat poverty, climate change — US economist Sachs” (Oct. 21). Not so: wealthy people and industrious entrepreneurs can easily move their capital and efficient business systems to other countries where there is little politics of envy.

2. Significant expansion in electricity generation leads to a significant expansion in GDP size and FDI inward stock. This is shown in the experiences of Vietnam, Indonesia, China, and India. And these four countries are all heavy users of coal power.

3. Focus on business and economics, trade and commerce, investments and tourism which will greatly propel our economy to industrialization. Do not focus on war mongering and war preparations. Focus on climate and energy realism, not alarmism.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.