The degrowth trend in the west, health parochialism in the Philippines

Canada finally released its second quarter (Q2) 2024 GDP data last week, or almost three months after the end of the quarter. Now we have the full data for the first half (H1), or Q1 and Q2 of the year, of the G7 countries. I compared the numbers for GDP growth and inflation rate over […]

Canada finally released its second quarter (Q2) 2024 GDP data last week, or almost three months after the end of the quarter. Now we have the full data for the first half (H1), or Q1 and Q2 of the year, of the G7 countries.

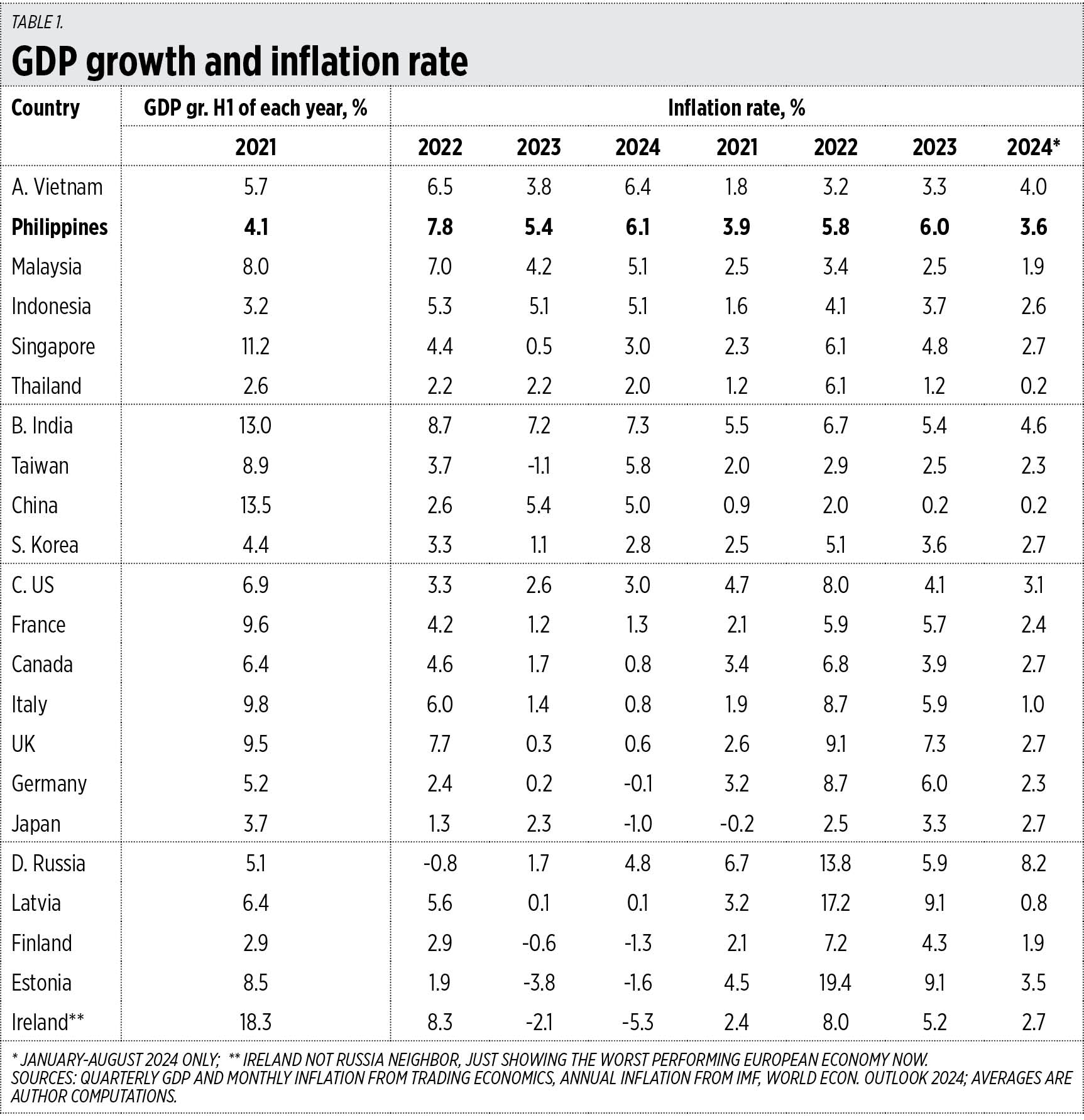

I compared the numbers for GDP growth and inflation rate over four years, 2021-2024, of four groups of countries. In Group A are the ASEAN-6, in Group B are the countries of Northeast Asia plus India, in Group C are the G7 member countries, and in Group D are Russia and its neighbors plus Ireland. The results show the following:

1. A significant growth slowdown, even a trend towards degrowth, is emerging in G7 countries. In H1 2024, only the US and France grew above 1%. They also suffered high inflation of 5.9% or higher in 2022, except Japan.

2. Group A and B countries grew at 3% or higher in 2024 except for Thailand and South Korea. They also experienced mild inflation in 2022.

3. Russia’s three neighbors that happen to also be NATO members — Finland, Estonia and Latvia — experienced even deeper degrowth than G7 members. Plus, Finland and Estonia saw double-digit inflation in 2022. Sanctions vs Russia tend to harm those who imposed the sanctions more than Russia itself (see Table 1).

Also, last week saw plenty of GDP revisions upwards by the US. Until about two weeks ago, these were the quarterly growth rates: 3.6%, 1.9%, 1.7%, 0.7% in 2022, and 1.7%, 2.4%, 2.9%, and 3.1% in 2023. Last week, with upward revisions, the growth rates became: 4%, 2.5%, 2.3%, 1.3% in 2022, and 2.3%, 2.8%, 3.2%, and 3.2% in 2023. The significant upward adjustments and revisions in US GDP numbers may be related to the coming Presidential elections next month.

The Philippines and other developing countries should avoid the policies of G7, especially those in Europe that are focused on saving others — the planet, Ukraine, and illegal immigrants — and other such concerns. We should instead focus on saving jobs and the economy from low growth and high poverty.

BTr’s CASH OPERATIONS REPORT

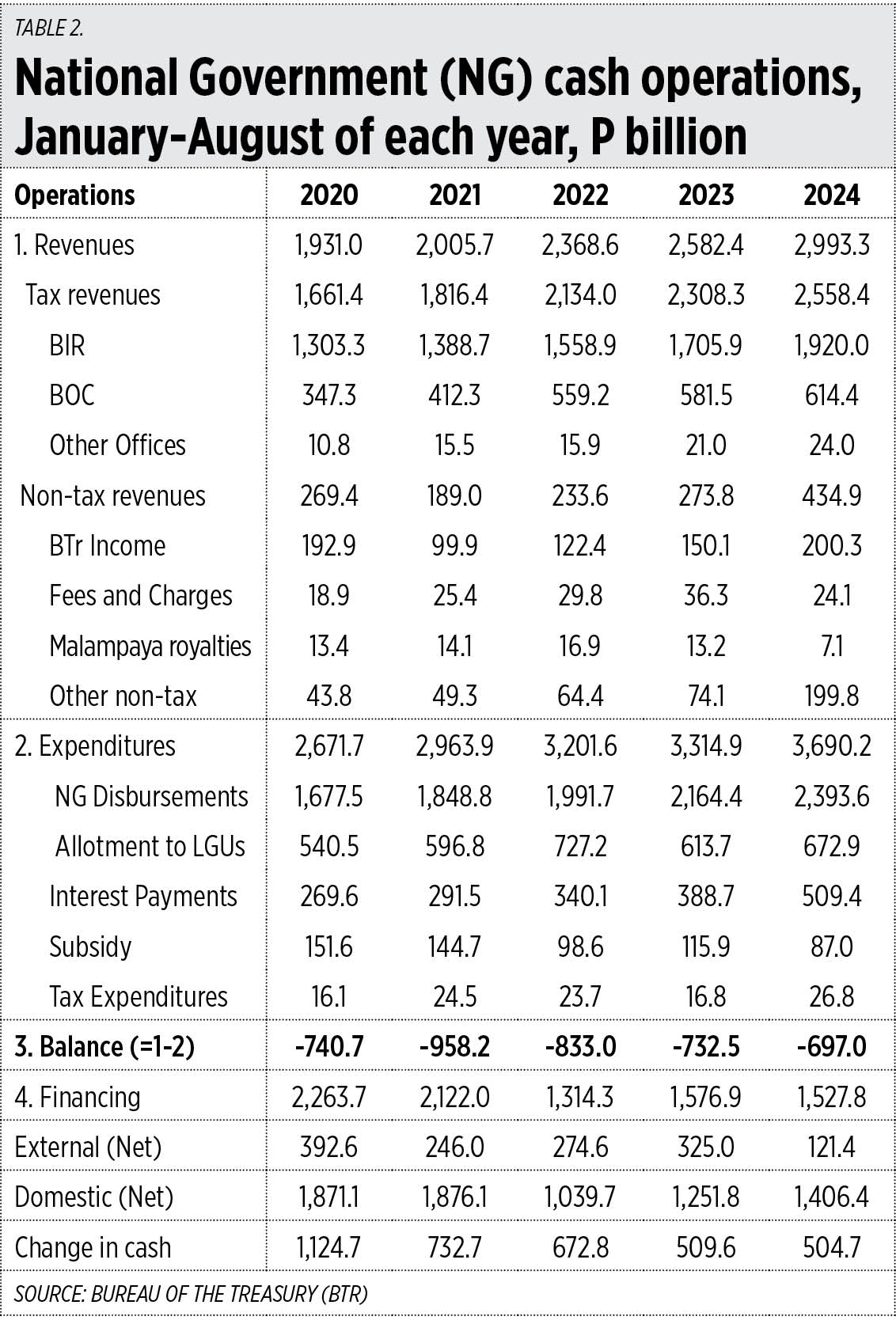

Last week, the Bureau of the Treasury (BTr) released the cash operations report for August 2024. I compared the numbers with those of the same period, January-August, from 2020-2023. Here are some important developments.

1. Revenues are nearly P3 trillion in 2024, almost 50% higher than the P2 trillion in 2021 or just three years ago. Non-tax revenues like remittances by government corporations and financial institutions kicked in high, from P74 billion in 2023 to P200 billion in 2024.

2. The rise in expenditures is mainly due to a rise in national plus local government disbursements, and interest payments for public debt — from P270 billion in 2020 to P509 billion in 2024 or nearly double in just four years. If the current trend in interest payment continues, the full year 2024’s interest payment would be P764 billion, with principal amortization not yet included.

3. It is the first time since 2020 that the deficit has been below P700 billion. Again, this is thanks to the jump in non-tax revenues which significantly raised overall revenues.

4. Financing or borrowing is still at P1.5 trillion in 2024, but at least this is lower than the P2.2 trillion average for 2020 and 2021 (see Table 2).

And now we go back again to the move by the Department of Finance (DoF) to tap the “idle funds” of the Philippine Health Insurance Corp., or PhilHealth, to finance some unprogrammed appropriations, including big infrastructure projects and healthcare worker benefits. I want to reiterate my arguments on why the DoF’s move is correct.

1. Those big unprogrammed appropriations can no longer be accommodated in the programmed appropriations of 2024 because the programmed appropriations are already huge, and the projected budget deficit is already at P1.48 trillion.

2. There are indeed Congressional pork barrel funds in the annual budget. But people forget or deliberately ignore that the budget also contains local governments’ pork barrel done via budget consultations at the regional development councils (RDCs), plus NGOs’ pork via budget consultation by agencies. These spending insertions by local governments and NGOs are incorporated when the Department of Budget and Management (DBM) submits the budget to Congress yearly.

For instance, the Department of Health (DoH) and other agencies consult the Alternative Budget Initiative (ABI), a big NGO network with sectoral clusters, about the agency’s budget. The annual DoH budget consultation with the ABI health cluster is done usually in early February of each year.

3. Tapping PhilHealth’s P90 billion in “idle funds” in 2024 means the government is not borrowing P90 billion, which at the current 5.8% interest rate (10-year bonds) would cost P5.22 billion/year in interest payments alone.

4. The DoF, DBM, and the National Economic and Development Authority (NEDA), which are the departments that comprise the economic team, have a wider overall view of all the agencies and sectors while the health lobbyists have a narrow and parochial view of the budget, which is why they say universal healthcare spending should prevail over many other agencies and sectors.

5. PhilHealth and the health advocates have become addicted to the tax money collected from gamblers (remittances from the Philippine Charity Sweepstakes Office and the Philippine Amusement and Gaming Corp.), smokers and drinkers (tax revenues collected from legal tobacco and alcohol). So much so that when these tax contributions are reallocated to unprogrammed appropriations even for one year, they get angry. Which demonstrates their double talk. They demonize alcohol and tobacco products as being “sin” products and unhealthy, yet they rely too much on taxes from alcohol and tobacco.

So, to help the health advocates become more consistent and avoid double talk, the DoF should proceed with using the extra revenue from gamblers, drinkers, smokers, and vapers to fund more infrastructure and other economic and social programs.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.